Not long ago, Samsung built a new mobile phone factory in Noida, India. This is also Samsung's second factory in India. It is said that this will be the world's largest mobile phone factory so far, and will achieve an annual output of up to 120 million mobile phones.

Prior to this, Samsung has invested a lot of factory resources in mainland China and other places, but as the growth of the domestic market slows, Samsung has also placed its vision and strategic focus on the Indian market.

In the past year or two, Apple and Foxconn, as well as a number of domestic mobile phones, have plans and actions to invest and build factories in India. As early as last year, Apple focused on hand-picking Wistron to manufacture a new generation of iPhone in India.

On the one hand, Wistron is expanding the production capacity of its ODM mobile phone factory in the suburbs of New Delhi, India. In addition, Wistron is building a new mobile phone manufacturing plant in Bangalore, India.

In January of this year, two government officials from India said that Wistron was about to sign a new land lease agreement with the Indian government. The new land will be mainly used to build a new factory and produce more iPhone models for Apple.

As early as 2016, Foxconn Group has signed an agreement with the Indian local government to invest US$5 billion to build a factory. In December last year, news pointed out that Foxconn planned to build a special economic zone in the Gavalar-Nehru Port near Mumbai, India. Jawaharlal Nehru Port Trust invested 60 billion rupees (about 6.154 billion yuan) to build a 200-acre (about 1214.06 acres) factory. Foxconn said the plant can provide about 40,000 jobs to the local area.

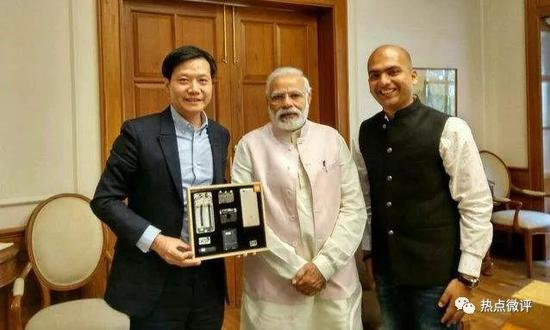

From the perspective of domestic mobile phone manufacturers, almost all Chinese mobile phone manufacturers have set up factories in India. Vivo, OPPO, Xiaomi, Gionee, etc. have invested in India to build factories, of which Xiaomi already has two factories. In April this year Said that it will build three more factories in India. More factories and supply chain supporting construction are under planning.

India welcomes a wave of opportunities to strengthen its position in the industrial chain

From these signals, it can be seen that India may transfer part of China’s mobile phone manufacturing industry chain to India in the next few years, thereby strengthening the production and assembly and R&D capabilities of mobile phones made in India, which in turn may lead to the development of China’s mobile phone manufacturing industry. Competitiveness is weakened.

On the one hand, there will be several driving factors for the shift of the mobile phone manufacturing industry chain. One is driven by business and demand. That is to say, the Chinese market has become saturated, with little room for increase, and demand for replacements has slowed, but the Indian market still has a huge demographic dividend.

This makes many mobile phone giants have listed India as a battleground. The Indian market has a large inventory and incremental demand for mobile phones. In order to quickly operate the business in localization, reduce costs, and efficiently increase shipments, mobile phone manufacturers will basically consider setting up factories in India. why? Because India has a population of 1.3 billion, the penetration rate of smartphones is only 30%. In other words, where the demographic dividend is, where is the demand, the supporting facilities related to the factory and the mobile phone manufacturing industry will be located.

Secondly, the Indian policy welcomes foreign investment to build factories to solve the employment problem in India. In addition, in order to attract more manufacturers to localize in India, the key strategy of the Indian government is to increase tariffs on the import of key components of mobile phones, so that more electronic manufacturers will be available. Reasons for direct investment and establishment of factories in India.

In India, land rent, labor costs, and equipment costs are all cheaper. On the contrary, domestic housing prices also indirectly push up manufacturing costs, including labor costs, logistics costs, plant costs, etc., and the demand for mobile phones is increasing. Therefore, the transfer of the mobile phone manufacturing industry chain that originally belonged to the Chinese market to India may already be an irreversible trend.

What impact will this have? First, it drives the Indian mobile phone manufacturing industry chain cluster. This kind of mobile phone manufacturing industry chain cluster has been experienced in China in the past. Because OEM manufacturers need to rely on complex and complex supplier industries to produce, demand, environment, and industrial ecology are closely related.

As early as 2014, an American study titled "Why Apple Produces iPhones and Almost All Products in China", the New York Times concluded that China has more mid-level engineers and has a huge labor force. With huge factories that can immediately increase production, there is no shortage of one-stop high-tech companies in China.

A former Apple executive once said to the New York Times: "The entire supply chain is now in China. Do you need 1,000 rubber washers? The factory next door has it. You need 1 million screws? The factory next door has it. You. Need to make a small change to the screw? Three hours will do."

But why is the mobile phone manufacturing supply chain in China? Of course, on the one hand, it is the development of China’s manufacturing industry and the improvement of supporting facilities, but don’t forget that on the other hand, it stems from the early development of the smartphone market. Due to its economic development and huge population, China has the largest potential for growth in the world. Smartphone market.

It is precisely because of the huge demand that mobile phone manufacturers need to compete for the demographic dividend in the Chinese market. Therefore, setting up factories in China and perfecting the upstream and downstream industrial chain of mobile phone manufacturing in China has become an inevitable way-it can be convenient and smooth. Realize localized production R&D, shipment, sales and marketing, and channel expansion. This has allowed Apple to invest heavily in the Chinese market, forming a supply chain cluster headed by Foxconn foundries.

But now the Chinese market has reached saturation through 5 to 6 years of rapid development, and there is not much room for incremental growth. Currently, the largest incremental space is in India. According to a study by Cisco Systems, India will have growth in 2021. 780 million connected smartphones, compared with 359 million in 2016.

Therefore, major mobile phone manufacturers need to slowly transfer the related supporting equipment of the mobile phone industry chain to India, because by establishing a base in the world’s fastest-growing market for smartphones-the Indian market, they can quickly enter the Indian local and export markets. chain.

According to industry reports earlier, there are two ways for Chinese mobile phone manufacturers to enter India to build factories. One is the integrated internal cycle of production, processing, and sales, and establish stable supplier partners to explore the market together. The other is the mobile phone ODM foundry model, which is OEM into India.

India may therefore usher in a wave of opportunities to strengthen the strength of its mobile phone industry chain. According to data, there are currently nearly 100 mobile phone-related companies in India. In the next 3-5 years, mobile phone core component manufacturers will gradually migrate to India. India may also copy the path that China has taken before, and will gradually and slowly realize the cluster of the mobile phone industry chain.

According to data, Foxconn currently has five manufacturing plants in Sri City, Andhra Pradesh, India, which manufactures nearly 15 million smartphones each year for manufacturers such as Xiaomi, Nokia, Gionee, and InFocus. Foxconn's India factory is still manufacturing smartphones and feature phones for Nokia, and manufacturing smartphones for other manufacturers.

In the modern economy, industrial agglomeration determines the status of the manufacturing industry. According to a statistics, the iPhone raw material and parts supply chain comes from 31 countries, of which China has the largest number of suppliers, reaching 349.

The camera modules, PCB circuit boards, antennas, FPC flexible printed circuit boards, speakers, touch motors, glass covers, glass back covers, metal structural parts, precision connectors, etc. in Apple mobile phones are all supplied by Chinese suppliers. This makes all major Apple supply chain manufacturers have to set up factories in China.

For example, 51 suppliers in Taiwan have 152 factories, 114 of which are in mainland China. The 47 suppliers in the United States have 217 factories, 69 of which are located in China.

In the Chinese market, it is precisely because of an integrated manufacturing cluster associated with the mobile phone industry that has enhanced the status of China’s mobile phone manufacturing industry in the world. This status was even irreplaceable in the past, but in the future, it will be irreplaceable. Will the status continue to exist? This is worth thinking about.

The sense of crisis in China's mobile phone industry chain and reflections on the manufacturing industry

At present, the United States is shouting that the manufacturing industry will return, and Foxconn, Apple, and Samsung have moved factories to India. In fact, it is an early warning for China's manufacturing industry.

Manufacturing as a physical enterprise is an indispensable part of China's economy. Like India, China is also a country with a large population. Employment is the guarantee of economic stability. If manufacturing is the foundation of a country’s employment, if there is no manufacturing industry, China’s economy will have a large-scale capital outflow.

In the mobile phone industry, the manufacturing of mobile phone parts plays an important role in the transformation and upgrading of the overall manufacturing industry, because the domestic manufacturing industry has always been given the impression of cheap, backward production capacity, and low-end sweatshops, which has been stigmatized for a long time. . Nowadays, young people in China are increasingly reluctant to enter the manufacturing industry.

Zong Qinghou, chairman of Wahaha, has also complained before: the real economy has relatively high taxes and fees, low profit margins and hard work, and many people are unwilling to engage in the real economy.

As far as India is concerned, although currently facing the problem of skilled workers, the major mobile phone giants have shifted their focus to India. India also has the opportunity to absorb more cutting-edge technology talents and accelerate the development of Indian mobile phone manufacturers to assemble, research and develop themselves. Ability to manufacture smart phones.

For example, we have seen that after Foxconn settled in Zhengzhou, Henan, it drove the downstream industries of the entire mobile phone production line in Zhengzhou, and the industrial cluster around Zhengzhou's factory group slowly took shape.

For India, when major manufacturers settle in the area, India will also have the opportunity to participate in the upstream R&D of the mobile phone manufacturing industry, drive the improvement of overall innovation, and drive the upstream and downstream industries of mobile phone production and R&D.

In the past, MediaTek also expressed its expectations for the Indian market, saying that the main battlefield for system integration chips has shifted from China, where demand has significantly slowed, to India, Southeast Asia and other places. Because the replacement demand in this place will bring a high growth rate.

In the Chinese market, there is another trend. Some practitioners said frankly earlier that the mobile phone models produced after 2016 range from main control chips and memory chips to camera modules, display and touch modules and other core components. , There is a trend of performance and overcapacity.

At present, there is a deeper demand for these core devices in the Indian and South Asian markets. The proportion of after-sales purchase orders for modules in the Indian and South Asian markets is almost 1 to 1.5 times more than that of mobile phone assembly factories, and this proportion will be even higher in the future.

Not good news for China’s mobile phone industry chain

As early as 2014, the Modi government of India put forward the slogan "Made in India" with great fanfare. The creation of a world manufacturing center is based on India's current national conditions and future strategic goals. From today's point of view, Indian manufacturing is gradually showing results.

In terms of market share of Indian smartphones, including local brands such as Lava, Intex, and Micromax in India, as well as Chinese mobile phone brand manufacturers Lenovo, Xiaomi, OPPO, vivo, etc., low-cost Android phones are still the main force in the market.

Although India's local mobile phone manufacturers Lava, Intex, Micromax and other brands have encountered the cannibalization of domestic mobile phones, their local mobile phone brands together with Samsung and domestic mobile phones constitute the main force of shipments in the Indian market.

In the past, the Indian mobile phone market was defeated in terms of technology and product quality in the competition with domestic mobile phones. This was also due to the lack of local supply chain foundry industry clusters in India. Many local Indian manufacturers such as Micromax rely on Shenzhen foundries to re-manufacture. Assemble and sell in India, but with the development of the local industrial chain in India, there are still opportunities for local Indian manufacturers.

For Apple and Samsung, the Chinese market is still a market that cannot be abandoned, but future strategic shifts may cause damage to the Chinese mobile phone industry chain. This may be worthy of domestic reflection. Are there any countermeasures? It's hard.

Because China is not like the United States. Although the US manufacturing industry itself is declining, it has always been at the top in terms of technology R&D and accumulation and the right to speak in the industrial chain. China's manufacturing industry is not the natural way for the United States to expand globally after its natural development to the top.

But when the industrial foundation and technological development level of the manufacturing industry are still in the development stage, capital, labor and talents are accelerating away from the manufacturing industry, and then flow to real estate and Internet industries, financial industries and other areas where money is fast.

The mobile phone industry is only a signal of the gradual outflow of manufacturing. There are three trends worth noting. One trend is that manufacturing giants such as Samsung, Toshiba, Panasonic, and Sony are considering reducing their capital in China and focusing on countries with lower costs.

Another trend is that the United States is also calling for American manufacturing to snatch manufacturing resources that originally belonged to China. It is worth noting that Americans have never given up manufacturing. American manufacturing has always been a strong pillar of the US national economy. Statistics show that in recent years Manufacturing companies returning to the United States have been growing.

There is also a trend that large domestic factories are also running out. Of course, this is also based on the needs of opening up foreign markets and launching global competition.

But what needs to be reflected is that at the time when the manufacturing industry is moving towards the Industry 4.0 era, the outflow of low-end manufacturing is an unstoppable trend. However, the current problem is that my country's manufacturing soil, cost, atmosphere and technical level are still insufficient. Support the development of high-end manufacturing.

If compared to countries with lower cost and greater market demand, the country lacks absolute dominant advantages in upstream technology, then in the future, more excellent manufacturing entities may move to more profitable countries.

Once the supply chain and industrial ecology of the manufacturing industry in these countries are formed, it means that a new “industrial commons” will be formed that is suitable for major factories. This is relatively weakening the competitiveness of domestic industrial chain clusters. Ours is not only reflection, but also crisis.